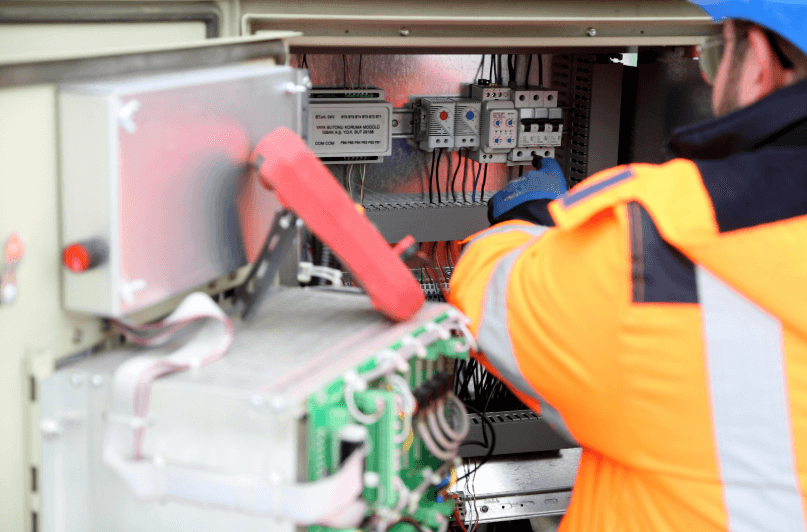

Electrician Insurance

Electrician insurance provides specialised protection for electrical contractors working with complex electrical systems in residential, commercial, and industrial environments. Electrical work creates unique risks, including fire hazards, electrocution dangers, and the potential for widespread property damage when electrical systems fail. Whether you’re a domestic electrician or industrial electrical contractor, comprehensive electrician insurance protects your business against the significant liability exposures and operational risks inherent in electrical work.

Public Liability Insurance

Essential protection against claims for electrical fires, electrocution incidents, property damage, and third-party injuries arising from electrical work. Electrician public liability coverage addresses the potentially catastrophic consequences of electrical failures, including house fires, electrical shock injuries, and damage to expensive electronic equipment. This coverage provides comprehensive protection for the significant liability exposures that electrical contractors face due to the inherently dangerous nature of electrical work.

Professional Indemnity Insurance

Protects against claims related to electrical design, compliance advice, safety certifications, and professional services provided alongside electrical installation work. Many electricians provide technical advice, system design, and compliance guidance that creates professional liability exposures. This coverage addresses claims alleging inadequate electrical design, incorrect compliance advice, or failure to meet electrical safety standards and regulatory requirements.

Tools and Equipment Insurance

Covers the expensive electrical tools, testing equipment, and specialised instruments that electricians rely on for safe and efficient electrical work. This protection includes hand tools, power tools, electrical testing equipment, cable pulling equipment, and diagnostic instruments against theft, damage, or breakdown. Electrician tool insurance recognises that electrical equipment represents a significant investment and that tool theft from vehicles and job sites is a common problem for electrical contractors.

Business Interruption Insurance

Replaces lost income when electrical contracting operations are disrupted by covered events such as equipment failure, vehicle damage, or regulatory issues affecting electrical licensing. Electrician business interruption insurance addresses the financial impact when electrical work cannot proceed due to covered events, including ongoing business expenses that continue even when electrical contracting activities are suspended.

Cyber Liability Insurance

Protects against data breaches, cyber attacks, and system failures affecting digital electrical systems, smart home installations, and client information storage. Modern electrical work increasingly involves connected systems, security installations, and digital controls that create cybersecurity exposures. This coverage addresses the growing intersection between electrical work and information technology systems.

Motor Vehicle Insurance

Covers work vehicles, electrical service trucks, and mobile equipment used for electrical contracting activities. Electrician motor insurance includes coverage for accidents, theft, damage to tools stored in vehicles, and third-party liability arising from vehicle use. This protection extends to specialised electrical service vehicles equipped with hydraulic lifts, cable storage, and electrical equipment that may not be covered by standard motor policies.

Product Liability Insurance

Covers claims arising from electrical components, fixtures, and equipment installed by electricians that subsequently cause injury or property damage. This protection addresses the responsibility electricians have for the electrical products they install, even when sourced from manufacturers or suppliers. Product liability coverage includes legal defence costs and compensation payments for incidents involving defective electrical components.

Pollution Liability Insurance

Addresses environmental risks from electrical work, including transformer oil spills, battery acid leaks, electrical waste disposal, and contamination from electrical equipment. Electrical contractors may encounter or create environmental hazards through their work, requiring specialised pollution coverage that addresses both gradual and sudden environmental incidents related to electrical systems and equipment.

Your protection -

Our priority

Don't let the complexity of insurance get in the way of your peace of mind. Simply fill out the form and one of our expert insurance brokers will contact you to help you find the coverage you need.

Latest News: See what's been going on:

Liability Insurance Explained What You Need to Know for Any Commercial Property Business Insurance: Essential Policies You Can’t Ignore to Shield

What is electrician insurance and how much does electrician insurance cost?

Electrician insurance is specialised coverage designed for electrical contractors, protecting against the unique risks of electrical work, including fire liability, electrocution hazards, equipment damage, and professional negligence claims. Unlike general trade insurance, electrician policies address the specific exposures created by electrical systems, high-voltage work, and the potential for catastrophic property damage from electrical failures. Electrician insurance costs vary based on work type, revenue, employee numbers, and risk factors. High-voltage industrial work and electrical design services may face higher premiums, whilst domestic electrical work may pay less.

Does electrician insurance cover electrical fires and property damage from electrical faults?

Yes, comprehensive electrician insurance typically includes coverage for electrical fires and property damage caused by electrical faults arising from the electrician’s work. Public liability coverage protects against claims for fire damage, electrical system failures, and property damage resulting from electrical installations or repairs. However, coverage may exclude pre-existing electrical problems, work performed outside licensing requirements, or damage from electrical work that doesn’t meet Australian electrical standards. It’s important to ensure adequate liability limits as electrical fire claims can result in substantial property damage and compensation costs.

How does electrician insurance address compliance with Australian electrical standards?

Electrician insurance policies typically require compliance with Australian electrical standards, licensing requirements, and workplace safety regulations as a condition of coverage. Most policies include provisions that claims may be denied if work doesn’t comply with relevant electrical codes, safety standards, or licensing requirements. However, professional indemnity coverage can provide some protection for alleged non-compliance issues, and many policies include legal defence costs even for compliance-related claims. Electricians should maintain current licensing, follow electrical standards, and document compliance to ensure insurance protection remains valid.

What coverage is available for electricians working on solar installations and renewable energy systems?

Electrician insurance can often be extended to cover solar panel installations and renewable energy electrical work, though specific coverage varies between insurers. Solar electrical work may require additional coverage for working at heights, specialised equipment, and the unique liability exposures of grid-connected renewable energy systems. Some insurers offer specific solar installer coverage that addresses system performance warranties, roof damage, and grid connection issues. Electricians involved in solar and renewable energy work should ensure their policy specifically covers these activities and associated equipment, as some standard policies may exclude or limit coverage for renewable energy installations.

Let us lead you to victory.

Why work with Knightsbridge Insurance Group?

Knightsbridge Insurance Group is an Insurance Broking Business with over 70 years of collective insurance experience and is founded on generational values that make you feel secure, protected and cared for. As we grow and expand the Knightsbridge Family, we continue to have a deep understanding of your desire to innovate and be extraordinary — both in business and in life.

The most important thing in communication is hearing what isn’t said.

Peter Drucker

Reach out to Kirsty today.

Kirsty is tenacious and driven in both her professional and personal pursuits. She is a go-getter, consistently inspired by the entrepreneurial spirit of Elon Musk. Outside of work, she enjoys yoga, boxing and jet skiing. She placed third in the world for karate at the age of nine, and now holds a Black Belt First dan in Karate.